"Sustainable development is the pathway to the future we want for all. It offers a framework to generate economic growth, achieve social justice, exercise environmental stewardship and strengthen governance..." - Ban Ki-moon

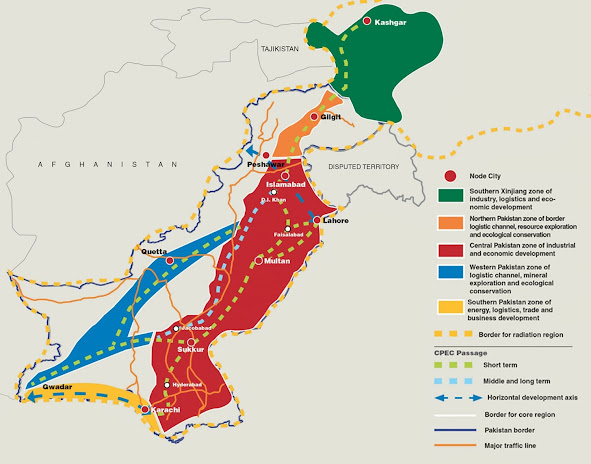

The China-Pakistan Economic Corridor (CPEC) is a significant infrastructure and economic development project that aims to connect Gwadar Port in southwestern Pakistan to China's northwestern region of Xinjiang. It is often referred to as a "corridor" because it consists of a network of roads, railways, pipelines, and other infrastructure projects that will facilitate trade, transportation, and economic cooperation between China and Pakistan.

CPEC was officially launched in April 2015 when China and Pakistan signed various agreements to kickstart the project. It is part of China's broader Belt and Road Initiative (BRI), which aims to enhance connectivity and economic cooperation across Asia, Africa, and Europe.

A significant portion of CPEC focuses on energy infrastructure. Pakistan faces energy shortages, and CPEC includes the construction of power plants, transmission lines, and other energy-related projects to address these issues. These projects aim to alleviate Pakistan's energy crisis and stimulate industrial growth.

Gwadar Port, located in Baluchistan province, is a central element of CPEC. It provides China with a direct maritime route to the Arabian Sea and the Persian Gulf, bypassing the longer and riskier journey through the Strait of Malacca. This offers strategic advantages to both China and Pakistan and potentially transforms Gwadar into a major regional trading hub.

CPEC has faced challenges and concerns, including security issues in certain areas, environmental concerns, and questions about the terms of financing and debt sustainability. There have also been debates about the extent to which CPEC will benefit local communities in Pakistan.

On the other hand, CPEC has geopolitical implications, as it involves China's increased presence in the region and potentially reshapes the dynamics of regional politics. It has drawn interest from other countries and international organizations, leading to discussions about its broader impact on the region.

Government of Pakistan has established CPEC Secretariat office in Islamabad.

Beyond infrastructure, CPEC encompasses various economic cooperation initiatives. Special Economic Zones (SEZs) are a key component, where industries and businesses are encouraged to set up operations with tax incentives and other benefits. These SEZs aim to boost industrialization and economic growth in Pakistan.

You must be wondering about what actually Special Economic Zones (SEZs) are?

Special Economic Zones (SEZs) are designated areas within a country that are subject to distinct regulatory and economic policies, offering unique incentives to attract domestic and foreign investment. SEZs are typically created with the goal of promoting economic development, industrialization, trade, and job creation.

SEZs

have the potential to bring Economic Incentives such as providing a range of

economic incentives to businesses and investors, including tax breaks, customs

duty exemptions, reduced regulations, and streamlined administrative

procedures. These incentives are designed to make it more attractive for

companies to operate within the zone. Also, governments usually invest in

developing infrastructure within SEZs, such as roads, utilities, ports, and

industrial parks. This infrastructure supports the efficient functioning of

businesses and reduces the cost of doing business.

Further, SEZs often have simplified customs procedures and quicker clearance processes, making it easier for businesses to import and export goods. This can be especially advantageous for manufacturing and export-oriented industries. It can lead to the creation of jobs within the zone and in surrounding areas. As businesses set up operations and expand, they hire local labor, which can have a positive impact on employment rates.

Most important factor is, it attracts technology-intensive industries and promote knowledge transfer through collaboration between local and foreign firms. This can contribute to technological advancement and skill development in the host country.

Special Economic Zones used as a tool to attract foreign direct investment. The favorable conditions offered within the zone can make the host country more competitive in attracting global capital, as well as play its part in regional development by encouraging economic activity in areas that may have been previously underserved or less developed.

The success of SEZs depends on factors such as infrastructure development, political stability, security, regulatory environment, and the ability to attract investment. While SEZs offer various benefits, they also raise questions about potential social and environmental impacts, as well as concerns about equity and inclusivity in the country's economic development.

In particular, Special Economic Zones (SEZs) play a crucial role in Pakistan's economic development, especially under the China-Pakistan Economic Corridor (CPEC) initiative. CPEC is a multi-billion-dollar infrastructure and economic development project that aims to connect Gwadar Port in southwestern Pakistan to China's northwestern region of Xinjiang, through a network of highways, railways, and pipelines. SEZs are an integral part of CPEC, designed to promote industrialization, trade, and investment in Pakistan.

Gwadar Port Free Zone: Located in Gwadar, Baluchistan, this is one of the most prominent SEZs under CPEC. It's strategically located on the Arabian Sea and provides access to international shipping routes. The Gwadar Port Free Zone aims to attract investments in manufacturing, logistics, and trade-related businesses.

Rashakai Special Economic Zone: Situated in Khyber Pakhtunkhwa province, Rashakai SEZ is expected to become a hub for manufacturing and processing industries. It is well-connected by road and will benefit from the proximity of the CPEC route.

Dhabeji Special Economic Zone: Located near Karachi, Sindh, Dhabeji SEZ aims to promote industries related to petrochemicals, automotive, and electronics. Its proximity to the Karachi Port and the upcoming infrastructure development will make it an attractive destination for investors.

Allama Iqbal Industrial City (M3) Faisalabad: This SEZ is located in Punjab and is geared towards promoting the textile, garment, and manufacturing sectors. It offers investors various incentives, including tax breaks and infrastructure support.

ICT Model Industrial Zone, Islamabad: This SEZ in the federal capital, Islamabad, is designed to attract information and communication technology (ICT) companies. It aims to foster innovation and technology-based industries.

Havelian Special Economic Zone: Located in Khyber Pakhtunkhwa, this SEZ is situated near the CPEC's western route. It focuses on manufacturing and industrial development.

Bostan Industrial Zone, Baluchistan: This SEZ aims to promote industries related to agriculture, food processing, and livestock. It will contribute to the economic development of the underdeveloped province of Baluchistan.

Under CPEC, these SEZs are being developed with the help of Chinese investment and expertise. They offer various incentives to attract both domestic and foreign investors, such as tax exemptions, simplified regulatory procedures, and infrastructure support. The development of these SEZs is expected to create jobs, boost industrialization, increase exports, and improve the overall economic outlook of Pakistan.

It is important to note that the success of these SEZs will depend on factors like political stability, security, effective governance, and the ability to attract foreign investment. Additionally, the sustainability and environmental impact of these zones should also be carefully managed to ensure long-term benefits for Pakistan's economy.

CPEC has the potential to bring substantial economic benefits to Pakistan by improving infrastructure, reducing energy shortages, creating jobs, and boosting trade. However, its success depends on addressing various challenges and ensuring that the benefits are distributed equitably across different regions of Pakistan. It also continues to be a subject of international interest and scrutiny due to its significance in regional geopolitics.

Chinese Loans and it's implications:

Chinese loans, often associated with China's Belt and Road Initiative (BRI), have become a significant source of financing for infrastructure and development projects in countries around the world.

Belt and Road Initiative (BRI) is a massive global infrastructure and economic development project initiated by China in 2013. It aims to connect China to Europe, Asia, Africa, and other parts of the world through a network of roads, railways, ports, pipelines, and digital infrastructure. Chinese loans are a major source of funding for many BRI projects.

Chinese loans can take various forms, including concessional loans, commercial loans, and export credits. Concessional loans typically have lower interest rates and longer repayment terms, while commercial loans are market-based and may have higher interest rates.

Chinese loans are often used to finance large-scale infrastructure projects, such as highways, railways, ports, airports, power plants, and telecommunications networks. These projects aim to improve connectivity, trade, and economic development in recipient countries.

Point of concern:

Chinese

loans have been criticized for their potential to create debt dependency in

recipient countries. Some argue that China's lending practices could be used as

a form of "debt diplomacy" or "debt-trap diplomacy," where

countries may struggle to repay their loans and could be pressured to make

concessions to China in return. Critics worldwide have raised concerns about

the lack of transparency and accountability in some Chinese loan agreements.

Some contracts may include confidentiality clauses, making it difficult for the

public and even the governments of recipient countries to fully understand the

terms of the loans.

Indeed, it is essential for recipient countries to carefully assess the risks and benefits associated with Chinese loans. This includes conducting thorough due diligence, negotiating favorable terms, and developing strategies to manage potential financial and geopolitical risks.

Chinese loans have undoubtedly played a significant role in financing infrastructure development worldwide, but they also raise important questions about debt sustainability, transparency, and the broader impact on the economic and geopolitical landscape of recipient countries and regions. It is crucial for both lenders and borrowers to ensure that these loans contribute to sustainable and equitable development.

Chinese loans to Pakistan and Srilanka have had significant economic and geopolitical implications.

Chinese loans have financed a range of infrastructure projects in Pakistan, including highways, railways, energy projects, and the development of Gwadar Port. These investments have helped improve transportation, energy supply, and connectivity in the country. A substantial portion of Chinese loans has been directed towards Pakistan's energy sector, helping to address the country's chronic energy shortages. This has led to the construction of power plants, transmission lines, and other energy-related projects. Chinese investments have contributed to economic growth in Pakistan, creating jobs and stimulating industrial activity. The China-Pakistan Economic Corridor (CPEC) initiative, in particular, has been a driving force behind economic development.

However, the influx of Chinese loans has also raised concerns about Pakistan's debt sustainability. Critics argue that the terms of these loans, including interest rates and repayment schedules, may lead to a significant debt burden for Pakistan in the future.

Srilanka's experience with Chinese loans, particularly the Hambantota Port project, is often cited as an example of the potential pitfalls of heavy reliance on Chinese financing. Srilanka borrowed heavily from China to finance the construction of the Hambantota Port, located in the southern part of the country. However, the project faced financial difficulties, and Srilanka struggled to repay the Chinese loans.

As a result of mounting debt, Srilanka was forced to negotiate with China. In 2017, the Srilankan government agreed to a debt-for-equity swap, which handed over a controlling stake in the Hambantota Port to a Chinese state-owned enterprise on a 99-year lease.

The lease of the Hambantota Port raised concerns about China's strategic interests in the Indian Ocean region. Some viewed it as an example of China using debt as a means to gain influence and control over critical infrastructure in other countries.

Srilanka's experience should and must led other countries to be more cautious in their dealings with China and to carefully evaluate the terms and implications of Chinese loans and investments.

No doubt, Chinese loans have the potential to bring much-needed infrastructure and economic development to countries like Pakistan and Srilanka. However, they also come with risks related to debt sustainability and potential geopolitical consequences. The Srilankan example serves as a cautionary tale, prompting countries to be more vigilant in negotiating and managing their engagements with China to ensure their long-term economic and strategic interests are protected.

Disclaimer:

Comments

Post a Comment